The real estate market in Spain has experienced significant growth in recent years, but owning a home can still pose a challenge for many young individuals and families.

To facilitate access to homeownership, the Spanish Government through MITMA and ICO has approved (see BOE, article 191) a series of measures to support the acquisition of primary residences, among which stands out a 20% guarantee program aimed at supporting homebuyers and promoting property acquisition.

In this article, we will explore the requirements to access these guarantees and the procedure to apply for them.

The 20% guarantees, which may reach up to 25% of the principal for properties with D ratin in Energy Efficiency Certificate , are targeted at young in dividuals up to 35 years old and families with dependent minors.

What are the 20% guarantees for the purchase of homes?

The 20% guarantees are a government initiative created to provide assurance to citizens who wish to purchase a home but face difficulties in meeting the typical requirement of providing a 20% down payment. Under this program, the Spanish Government acts as a guarantor and offers a guarantee of up to 20% of the property’s value, allowing buyers to access better mortgage financing terms and, in some cases, even avoid the need for a significant upfront payment.

Requirements to access the 20% guarantee:

- Spanish citizenship or legal residency: To benefit from the 20% guarantee, it is necessary to be a Spanish citizen or have legal residency in the country.

- Age limit: Only individuals of legal age can apply for this guarantee program.

- Not owning another property: Potential beneficiaries must not own any other property, whether in Spain or abroad. It must be their first primary residence. There are some exceptions in realtion to properties adquired by inheritance or in cases of divorce.

- Solvency and payment capacity: Applicants must demonstrate financial solvency and the ability to handle mortgage payments, which involves having stable and sufficient income to meet the mortgage installments.

- Maximum property price: The 20% guarantee applies to properties whose price does not exceed a limit established by the Government. This limit may vary based on location and other specific circumstances. Additionally, the guaranteed mortgage cannot exceed 100% of the lower value between the appraisal and the purchase price of the property.

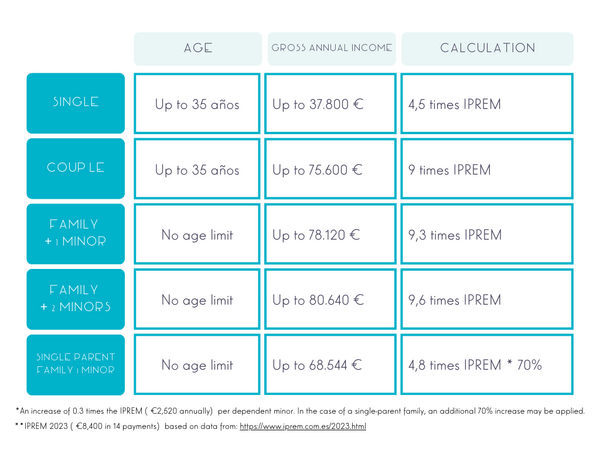

- Eligibility based on personal and economic characteristics:

*An increase of 0.3 times the IPREM (€2,520 annually) per dependent minor. In the case of a single-parent family, an additional 70% increase may be applied.

**IPREM 2023 and 2024 (€8,400 in 14 payments) based on data from: https://www.iprem.com.es/2023.html

Procedure to apply for the 20% guarantee:

- Contact the bank: The first step to apply for the 20% guarantee is to approach a bank that participates in the Spanish Government’s guarantee program.

- Gather documentation: The bank will require certain documentation, including personal identification, proof of income, credit history, and details about the property intended for purchase.

- Bank evaluation: The bank will assess the applicant’s financial solvency and determine if they meet the requirements to access the guarantee.

- Request the guarantee: Once the bank has approved the application, the process of obtaining the 20% guarantee from the Spanish Government will be initiated.

- Formalize the mortgage: With the guarantee granted, the buyer can proceed to formalize the mortgage to acquire the property.

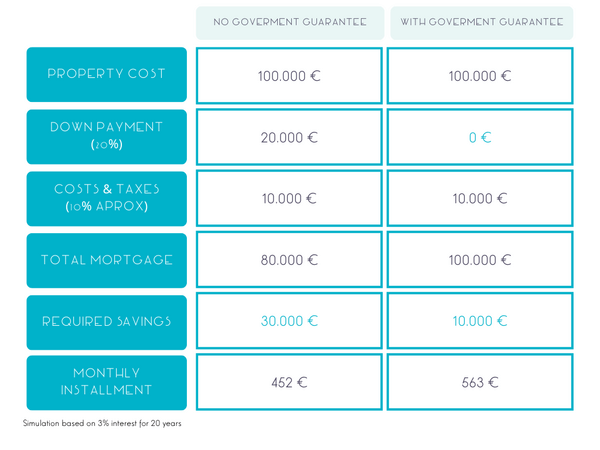

How will a purchase be financed with the 20% guarantee?

Example for a €100,000 property:

This program by the Spanish Government aims to facilitate access to homeownership and stimulate the real estate market. The 20% guarantees represent a valuable opportunity for citizens who wish to buy a home and need financial support to meet the entry requirements, allowing them to access a purchase with a small amount of contributed savings

If you meet the mentioned requirements, do not hesitate to explore this option and seek advice from a law firm specialized in real estate law, such as BLAU ABOGADOS, to obtain personalized assistance in the application process.

Leave A Comment