In Spain, taxation of property rentals owned by non-residents has undergone a significant change starting January 1, 2024.

For all incomes generated in 2024, it will be possible to choose between submitting a single annual declaration or continuing to submit them quarterly.

This modification considerably simplifies administrative procedures for non-residents who decide to rent out their property in Spain. The AEAT takes a further step towards simplification, reducing tax burdens on foreigners and encouraging and facilitating non-residents’ investment in Spanish real estate.

Starting in 2024, non-residents who rent or sublet their properties in Spain will be able to submit a consolidated annual declaration with all incomes obtained during the period.

We at Blau Solicitors welcome this measure and believe that this simplification helps improve non-residents’ relations with the Spanish tax system. By reducing administrative and tax burdens, compliance with tax obligations is facilitated for all non-residents.

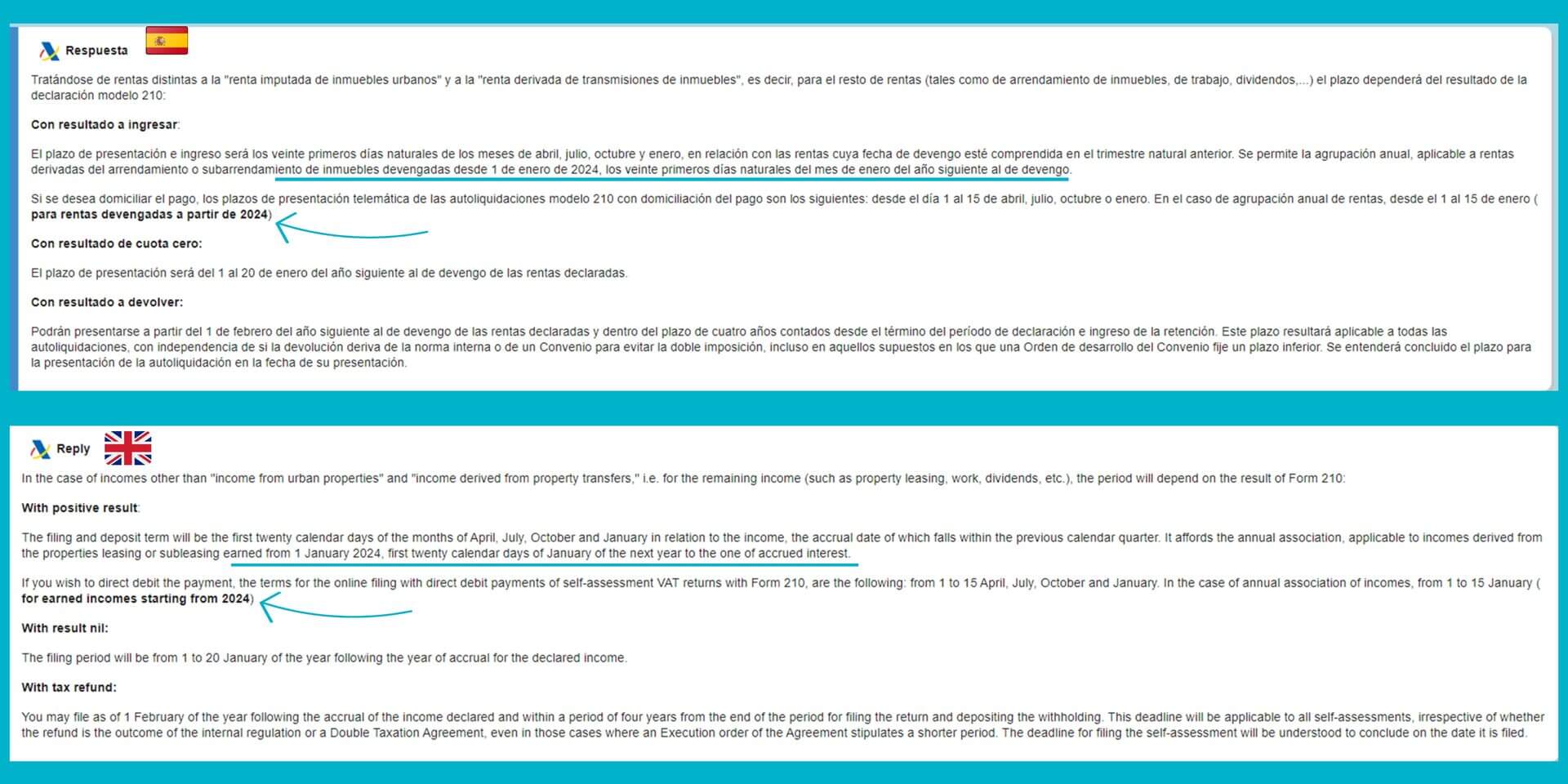

What are the deadlines and submission methods for Form 210 starting in 2024?

According to the AEAT website (Click), for positive incomes derived from property rentals and sublets, annual grouping is allowed starting in 2024. Therefore, for all incomes accrued from January 1, 2024, a single Form 210 must be submitted within the first twenty natural days of January of the following year.

In other words, this reform opens up the possibility for all incomes obtained in 2024 to be declared in a single tax form 210 to be submitted from January 1st to January 20th, 2025.

The 210 form will be submitted from January 1st to January 20th of the following year.

However, this is an option; for now, non-resident taxpayers are allowed to continue submitting quarterly forms.

The changes in the taxation of property rentals in Spain for non-residents starting in 2024 represent a simplification and improvement in the administrative process, transitioning from quarterly to annual declarations. This benefits both non-resident property owners and the tax system in general by facilitating compliance with tax obligations and promoting greater transparency in the real estate market.

Do you need to file your taxes in Spain for income derived from property rentals? Blau Abogados can assist you.

Leave A Comment