How does the Housing Law affect Real Estate professionals?

We summarize the 10 most important points of this Law 12/2024 of May 24, 2023, on the right to housing, for real estate professionals in Spain: agencies, investors, and property owners.

Main modifications and changes to consider in our daily activity:

1. Intermediation fees or any other contract formalization expenses cannot be passed on to the tenant.

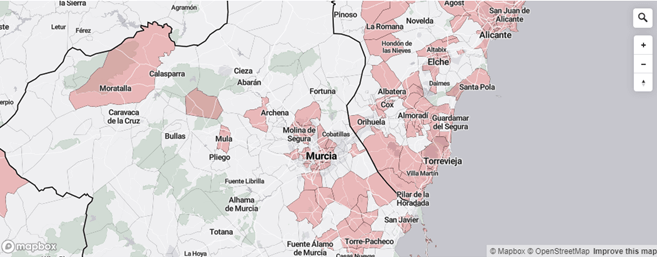

2. Limitation of rental prices in areas designated as “zonas tensionadas” (tense area) by the Autonomous Communities in coordination with the Municipalities.

What is a tense area (“zona tensionada”)?

When one of the following two requirements is met according to article 18 of the Law:

A) Overburden in housing payment (more than 30% of income) for households in the area.

B) Price increase of more than three percentage points above the increase in the Consumer Price Index (CPI) over a five-year period.

Sureste Español zonas tensionadas

3. Maximum annual increase during the year 2024 of 3% for existing contracts. A new index will be published starting from 2025. Let’s remember that the limit in 2023 is 2%.

4. In tense areas, the tenant may choose to extend the lease contract once it expires, annually and for a maximum of 3 years.

5. When the landlord is a “gran tenedor” (grand landlord), the rent of new contracts signed in tense areas will be limited, if applicable, by the previous contract or the maximum price limit applicable according to the reference price index system.

What is “gran tenedor” (grand landlord) ?

A grand landlord is the owner of 5 properties in a tense area or 10 in a non-tense area, or 1,500m2 of residential surface area excluding garages and storage rooms.

6. Extraordinary extension in the lease contracts of one year for situations of accredited social or economic vulnerability.

7. In new lease contracts for properties already on the rental market for new tenants, the limitation of rent in these tense areas is established, in general, based on the rent of the previous contract, allowing certain additional maximum increases in certain cases, such as energy rehabilitation, improvements to the property, or long-term contracts (over 10 years). Such increases cannot exceed 10%.

8. IMPORTANT It is necessary to adapt sales and rental contracts to the provisions of Article 31 of the Law regarding the minimum information available to the buyer-tenant. IMPORTANT

9. Increase in the Property Tax (IBI) for vacant properties:

- 50% increase if it has been vacant for 2 years,

- 100% if it’s 3 years, and

- 150% or more thereafter.

To apply such an increase, it will be necessary for the administration to certify the “vacant property” situation.

10. Different Personal Income Tax (IRPF) bonuses are established for property owners that can reach up to 90% of the income obtained when the same lessor has entered into a new lease contract for a property located in a tense market area, where the initial rent has been reduced by more than 5% compared to the last rent of the previous lease contract.

Remember, according to Fourth transitional provision. Lease contracts subject to Law 29/1994, of November 24, on Urban Leases, entered into before the entry into force of this Law, will continue to be governed by the provisions of the legal regime that was applicable to them.

Do you need to update the contracts of your Real Estate Agency? Or revise the legal matters of your Real Estate investment portfolio? We can help you, we are experts on Real Estate business and conveyancing.

Leave A Comment